A STUDY ON THE APPLICATION OF ENTITY THEORY IN PARTNERSHIP

NEERAJA PRAKASH

Student, M.Com

Business entity concept states that the business is a distinct entity from its owners with separate legal existence and perpetual sucession.The study aims to apply the entity theory in partnership and find and its scope with reference to Indian partnership act. The data is collected from secondary sources ie, books, published journals and websites. The study revealed that entity theory can be applied to partnership as emergence of limited liability partnerships, with some limitations in respect of taxation purpose and and raising fund from public in its own name.

Keywords. Limited liability partnership, Entity theory

INTRODUCTION

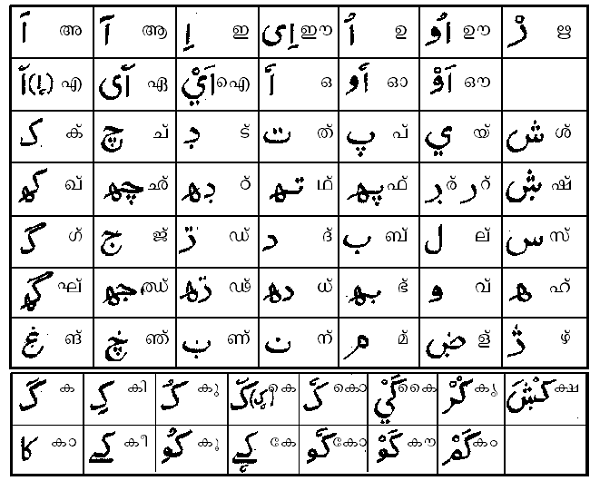

The entity theory in accounting means a basic assumption the business entity is separate from its owners. Business Entity is considered as a separate legal entity which is distinguishable from its owners. As company have a distinct identity from owners, it is considered as an economic and individual legal unit. the business unit have its own resources ,maintains its own accounts liable to pay tax in its own name and its liable to shareholders as well as creditors. The topic for the study is application of entity theory in partnership. Entity theory can be applied to companies or large corporations, when applied to partnership, here are so many limitations .Generally partnership is not considered as a separate legal entity. In sole proprietorship or in a partnership the business owners assume full liability for the business. For a partnership, not only are the assets of the partnership itself subject to the claims of creditors, but also the assets of each individual partner can be claimed when a liability arises. Each partners pay tax for their individual income. The term 'partnership' is defined under section 4 of Indian partnership act 1932 as under "Partnership is an agreement between two or more persons who have agreed to share profits of the business carried on by all or any one of them acting upon all." In other words, under the common-law theory, a partnership was but a convenient name for an aggregate of individuals, and the rights and duties recognized and imposed by law are those of the individual partners. .In contrast, the mercantile theory of the law merchant held that a partnership is a legal entity that can have rights and duties independent of those of its members. For the tax purposes, aggregate theory are used in the case of partnership, ie, tax is paid on partner level .application of entity theory in partnership is a debatable topic even now. The contrast nature of partnership and entity theory is the major limitation. The partnership law also differs between different countries. Each country has its own law about the functioning and tax-ability of partnership laws has not universal application. As unlimited liability of members is major limitation for the application of entity theory in limited liability partnerships are given more consideration in this study.

OBJECTIVE OF THE STUDY

The study intends to find out how entity theory can be applied to partnership. The major objectives are

● To evaluate the scope of entity theory in partnership

● To study different types of partnership and application of entity theory in each type

● To know and find out the functioning and application of limited liability partnership to obtain an understanding about partnership laws

METHODOLOGY OF THE STUDY

The study is conducted on the basis of the data collected from various journals ,sites, newspapers, textbooks ,scholarly articles published by different secondary data is mainly used for the analysis.

LIMITATION OF THE STUDY ● lack of primary data collection .limitation of secondary data will apply

● time constraints

● limitation of convenience sampling will apply #for convenience, partnership act and laws in India is only taken into consideration.

REVIEW OF LITERATURE In Columbia Law Review, Vol. 41, No. 4 it is concluded that in case, if partners incurs a joint liability for a non partnership purpose ,the joint creditors does not have the same right as partnership creditors .under entity theory firm as a legal unit have its obligations distinct from its members .the joint creditor this not treated equally with partnership creditors. But due to insufficient laws and absence of specific conditions, each court decides based on law prevailing in that state. The study concluded that it is not important to find whether a partnership is a legal entity or not ,more attention should be given to find out to what extend ie ,when and where the firms obligations should be treated different from its partners by considering factors like insurance, business practice and joint obligations

Partnership: Legal entity theory Michigan law review ,volume 10,no.7 in the study it is said that by the statue partnership is considered as a separate legal entity for the purpose of tax-ability in several states of America. it is said that partnership as a separate legal entity is the only solution for conflicts in the distribution of assets and paying off of creditors liabilities at the time of dissolution of partnership.

NEED OF ENTITY THEORY IN PARTNERSHIP The need for applying entity theory in partnership is because of major limitations or disadvantages faced by partnership as a business unit

● Unlimited personal liability for debts of the firm, it is even more than in case of sole proprietorship because a partners obligation include the common debt for the partnership which is due to the actions of another partner also. ● Risk of discontinuity of partnership. A partnership is automatically terminated if any one of partner is dead. • Partnership cannot issue public stock offering to acquire finance for the partnership.

DATA ANALYSIS AND INTREPRETATIONS

Partnership as a legal entity can be explained through Morris V.S Owen case ,Texas(1912) Defendant and plaintiff’s husband were partners of affirm which was dissolved during the death of a partner, defendant formed a new firm and sold the property of the property of partnership to new firm as a surviving partner .in the case filed by defendant instructed the jury that if the facts are true the sale shall be invalid. PRESLER J in delivering opinion to the court said that “it is well settled that firm or a partnership is a legal entity of itself, existing apart from individuals composing it, we think the transfer or sale made in good faith shall be sustained”. the case is won by defendants by considering partnership as a separate legal entity . According to section 4 of the Partnership Act of 1932, which applies in both India, “Partnership is defined as the relation between two or more persons who have agreed to share the profits of a business run by all or any one of them acting for all”.This definition superseded the previous definition given in section 239 of Indian Contract Act 1872 as – “Partnership is the relation which subsists between persons who have agreed to combine their property, labour, skill in some business, and to share the profits thereof between them”. The 1932 definition added the concept of mutual agency. The Indian Partnerships have the following common characteristics:

According to Indian partnership act the partnerships have following characteristics:

● A partnership firm is not a legal entity

● Partnership is a concurrent subject.

● Unlimited Liability.

● Partners are Mutual Agents.

● Oral or Written Agreements.

● Personal income is taxed as the profit and loss are shared among partners., In India partnership is seen not as separate legal entity as per partnership act 1932.but due to the need for developments and to cover the limitations partnership are further divided into different categories

● general partnerships

● limited partnerships

● limited liability partnerships

General partnerships and Limited partnerships do not see company as a separate legal entity. In general partnerships there may be 2 general partners assuming all liability and in limited partnership 1 general partner and one limited partner may be there. In these types of partnership entity concept is not followed and only concern is to protect partners’ interest.

Limited Liability Partnership Act 2008

This paved way for emergence of Limited liability partnership act in India .Limited liability partnership act 2008 was enacted by parliament to provide legal sanction to LLP in india.LLP is a body corporate which is a separate legal entity separate from its partners and perpetual succession. This provides limited liability to the partners and the accounts are prepared from the point of view of the entity only.

Salient features of limited liability partnership

The limited liability partnership act and the legality of LLP are different in different countries.

The following are main characteristics of Limited liability partnership in India:

● Separate legal entity: Entity is separate from its members like a company.

● No of members: minimum is two no limit for maximum

● No requirement for minimum amount of capital

● Compulsory audit is not required. ● It can buy rent or lease it own property

MAJOR FINDINGS

Application of entity theory in partnership is possible with some unavoidable limitations.

It is possible to apply entity theory in partnership if the

● If the accounts of partnership is prepared and analysed from the point of view of the company as an operating unit.

● Accounting principles and procedures are formulated by taking the firm as a separate legal entity The emergence of limited liability partnership has came to picture because of various limitations of partnership but it has its own merits and demerits

Merits are

✔ There is no limit for maximum no. of members

✔ Partners are free from the burden of unlimited liability

✔ Partners are not responsible for negligence and misconduct of another partner.ie ,there is no joint liability

✔ It can buy rent or lease it own property

✔ In case of death of a partners,LLP Will continue to exist with other partners

Limitations to Limited liability partnership to apply entity theory

✔ LLP cannot raise funds from public in its name

✔ For taxation purpose, LLP is also treated as any other partnership firms, while under separate legal entity concept, the firm is taxed distinct from its partners

SUGGESTIONS AND CONCLUSION

The very nature of partnership, taxation on individual income as profit pass through partners and taxed , limitations to go for a public issue are still a limitation for partnership companies for applying the entity theory. The study concludes that entity theory can be applied to partnership, with the emergence of limited liability partnerships there is more scope for it as there is limited liability and no termination of partnership at the time of death of any partner. But there need of universally applicable and well structured laws and specifications. There is more scope for research under this area the application of entity and aggregate theories in partnership and their affects and comparative analysis on limited liability partnership in different countries

BIBLIOGRAPHY www.jstor.org

https://wordpress.com

https://en.wikipedia.org

www.mca.gov.in

www.investopedia.com

www.saylor.org

Accounting theory Godfrey Jayne , Hodgson Allan, Holmes Scott