CRITICAL REVIEW ON POLITICAL COST AND FIRMS SIZE

MUHAMMED NISAR M

Assistant Professor, KTM COLLEGE OF ADVANCED STUDIES, Karuvarakundu

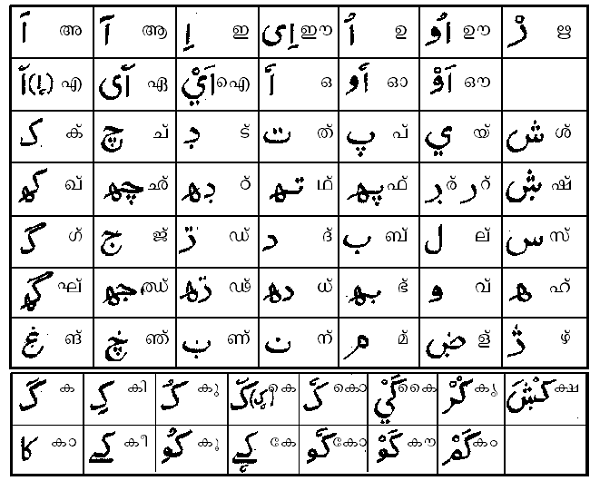

In late of 1960th the studies on accounting theories were turn into positive approach than the previous normative one. Positive theories try to study `what is` than ‘what it should be’.it try predict how accountants react in different situations. Due to the works of Watts and Zimmerman it has become into a separate school of thought in accounting researches. It is more concerned with the contractual set up of firms. A firm is considered as a nexus of different contractual relations. Accounting is considered as a tool to maintain such contracts

Positive accounting mainly has two different perspectives efficiency perspective and opportunistic perspective. Through the Efficiency view of positive accounting theory researchers try to find what accounting procedures and methods are used by different managers to show true and actual performance of the firm.

Opportunistic view stipulates there is potential conflict of interest between managers and shareholders, shareholders design management compensation contracts in order to constrain management to act in their best interest. Theoretically, management compensation contracts are viewed as devices to reduce the conflict of interest between managers and shareholders and thereby, maximise a firm's value. However, these compensation contracts may induce earnings management simply because managers' compensation is either based on accounting earnings or stock prices. There is a possibility that rewarding managers on the basis of reported earnings or stock performance may induce them to manipulate earnings figures to improve their apparent performance and, ultimately, their related compensations.

This opportunism is mainly supported by Bonus plan hypothesis, Debt covenant hypothesis and Political cost hypothesis. Bonus plan hypothesis states that bonus and accounting earnings are piecewise linear functions with lower and upper bounds defined in the funding formula for use in bonus computations. Healy (1985). if manager`s remuneration depends on performance, they may adopt accounting procedures which shows higher earnings to increase his remuneration. Same way Debt covenants assumes that if firm is more depend upon debt, the managers may tend to adopt income increasing discretionary accruals to show higher liquidity and higher earnings.

On the flip side of the same coin Political cost hypothesis states that managers may tend to adopt more income decreasing discretionary accruals to avoid concentration of its political environment. If firms show real profit and wealth then it may incur political costs like tax and other levies to government, contribution to political parties etc.

This paper focus on political cost hypothesis. Many researches have been interested to test the relationship between political cost and firms size. The fundamental problem they face is the choice of proxy variables to measure firms’ size. There are many variables available to determine firms’ size like volume of asset, annual sales, number of employees etc. Through the analysis of previous studies this paper is intended to test whether There is any meaningful relationship between political cost and size of the firm

2.ANALYSIS OF PREVIOUS STUDIES

Watts and Zimmerman conducted the first research on political cost in 1987. And they found that there is a positive correlation between size of the firm and political cost. They were stated that the political cost for large firms is higher than the small firms. They conducted several experiments to test political cost. They tested relationship between firm`s size and social disclosure in some cases. They were taken tax, insurance, gratuitous helps, sports help, customs and other levies as political cost. And they concluded that manger will adopt accounting polies and procedures which disclose lower income to avoid political cost

Belkouei and karpics conducted a research in 1989. He taken 23 American companies. They stated that not only firms’ size but also the industry that firm belongs affect the political influence.in 23 companies out of 7 companies were large oil companies. according to them the size of the firm and industry can show the correlation between them and political cost.

They understood that in some special industries like oil and gas, chemical industries the influence of politics is high irrespective of individual firm`s earnings and profit. Large companies are more politically sensitive. The tax rate for large companies are high than small companies. Tax constitute political cost. And finally, they also concluded that there is relationship between firm`s size and political cost. large companies will incur high political cost than small.

Leftwich and holthausen also conducted a research in this field in 1983. They tested the relation between firm`s size and the choice of accounting methods. The research was based on Zimmarman`s research. They also came into the conclusion that the size of the firm correlated with political cost. Thereby there is correlation with selection of accounting policies also.

Firouzi have conducted a research in 1998. He tested the political cost hypothesis by testing the relation between size of the firm and sales volume then, volume of asset and firm`s size. The study was das on the past data for the past 3 years. The results were shown that there is good correlation of political cost based on sales volume, however there is no significant correlation on the basis of asset and political cost. But the average correlation for the past three years on the basis of both asset and sales were shown a positive correlation.

Godfrey and Jones also conducted another research on political cost in 1999. But he used market shares to measure the effect of political cost. He taken market shares of firms and profit as variables. The research report shows that companies having more government investments or government managed companies have higher political cost. Another finding is that companies engaged in business of banking, finance, research fundamentals, urban service etc. also incurs more political costs

In 1991 Deeganand Hallam conducted a research. The research was based on market shares of the firm. The research found that the companies having more market shares in the industry will have more political cost. They calculated market shares on the basis of total asset.

In 1998 Darough and his associates conducted a study and published a report. The study also tried to build a relationship between size of the firm and political cost. But instead of taking asset or sales volume to measure the firm`s size he used the number of employees working in in the firm. they tested the relation between these two and found that the political influence for firms having a greater number of staff is higher than the firms having a smaller number of employees.so finally the research was concluded that there is correlation between firm`s size and political cost.

Recently in 2009 Reza Tehrani and his associates published a paper. The conducted a research by taking data for companies in Iran for 2005 and 2007. They were taken companies size as independent variable and political cost as dependent variable. according to them political cost includes tax, insurance rights, help to sports, help to educational area development, cost on establishing seminars and conferences, protection of bioenvironmental costs, export and customs levies etc. to measure the firms size they combined two variables volume of sales and total assets. they found that the there is significant relationship between firm`s size and political cost. As the size of firm increases its political cost also increase and If firms size is less then, the political cost also decreases. There is positive correlation between firm`s size and political cost

3. CONCLUSION

The previous studies unanimously agree that there is meaningful relationship between firm`s size and political cost. bigger the firm more the political cost and vice versa. This political sensitivity can be seen as a root course of earning management. But the proxy choice to measure the firm size questions the generalisability of current literature. Determination of firm’s size is mainly depending on the nature of business and industry. Different scholars have different proxy to measure the size like volume of asset, annual sales, number of employees. This proxy identification issue is not properly addressed.to have more generalisable and concreate outcomes, the researchers in this line have to consider resolve this proxy choice issue.

Political cost can be divided into two types, controllable and uncontrollable. The first is avoidable, which includes celebration expenses, election cost etc, but the latter is unavoidable, which includes tax and license fee etc.

4. REFERENCES

Healy, P., (1985), “The Impact of Bonus Schemes on the Selection of Accounting Principles”, Journal of Accounting and Economics, Vol. 7, April, pp. 85-107. Watts. R.L. & Zimmerman. J.L., (1978), “Towards a Positive Theory of the Determination of Accounting Standards”, The Accounting Review, Vol. 53, No 1, pp. 112-134. Watts. R.L. & Zimmerman. J.L., (1979), “The Demand for and Supply of Accounting Theories: The Market for Excuses”, The Accounting Review, Vol. 54, No 2, pp. 273-305. Watts. R.L. & Zimmerman. J.L., (1986), Positive Accounting Theory, Prentice-Hall, London. Adams, C.A., W.Y. Hill and C.B. Roberts (1995), Environmental, Employee and Ethical Reporting in Europe (London: ACCA).

Adams, C.A., W.Y. Hill and C.B. Roberts (1998), “Corporate Social Reporting Practices in Western Europe: Legitimating Corporate Behaviour?” British Accounting Review, Vol. 30, No. 1, pp. 1-21. Alchian, A.A., and Kessel, R., (1962), “Competition, Monopoly and the Pursuit of Money”, in Aspects of Labor Economics, pp. 157-175. Princeton, N.J.: Princeton University Press, National Bureau for Economic Research. Ball, R.J., and Foster, G., (1982), “Corporate Financial Reporting: A Methodological Review of Empirical Research”, Studies on Current Research Methodologies in Accounting: A Critical Evaluation, Supplement to Vol. 20, Journal of Accounting Research, pp. 161-234. Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3, 305–360.

Belkaoui, A. & Karpik, P.G., (1989) “Determinants of the Corporate Decision to Disclose Social Information”, Accounting, Auditing & Accountability Journal, Vol. 2, No. 1, pp.36-51. Beresford, D.R., (1974), “How Companies are Reporting Social Performance”, Management Accounting (NAA), August, pp. 41-44. Blacconiere, W.G., and Patten, D.M., (1994), “Environmental Disclosures, Regulatory Costs, and Changes in Firm Value”, Journal of Accounting and Economics, Vol. 18, pp. 357-377. Blair, J.M., (1976), The Control of Oil, Pantheon Books: New York.