Abstract, The main theme of Islamic finance, the equity and morality, are the universally accepted principles of justice and fairness. Islamic finance replaces the greed with the accountability to God. The Quran (2:30) states that Man is created as the representative of God on the Earth. This Quranic guidance enables man to conserve and use prudently all the resources on the Earth.

The totality of ethical concerns can be summed up as to justice and benevolence. Justice is rendering to each what is his due. The principle of ‘no-injury’ is the base for justice. Honesty, truthfulness, avoidance of unclear contracts and transactions, avoidance of illegal considerations and one side benefited agreements are signals for unjustified business. Good behavior, generous dealing, sympathy, empathy, tolerance, humanity, mutual consideration etc. are the Islamic benevolence concepts. This paper describes how these ethical elements are applied in business in the Islamic shariah perspective.

Key words:

Islamic finance, Islamic ethics, Shariah, Divine ownership and Ethical investment INTRODUCTION

Islamic finance is the system based on the principles of Islamic law (shariah) and guided by Islamic economics. Islamic financial thoughts are originated from the Quran, the holy book of Islam; and Sunnah, the deeds, statements and unspoken approvals of Prophet Mohammed (pbuh). Shariah principles consist with prohibition of unethical, immoral and speculative activities.

The concept of Islamic finance and banking originated centuries ago, but the modern Islamic banking and finance movement is a recent phenomenon starting from the early 1970s. Now it is in formative stage. It is likely to continue developing in Middle East, South East Asia and Europe. The first full-fledged Islamic financial institution is the Dubai Islamic Bank established in 1975.

Ethics is a branch of social science that says about the moral standards and behaviors of a society. It refers to rules that an individual or group has about what is wrong and right. Religion is a prime force for shaping our ethics. Islam says about almost all aspects of commercial dealings such as ethical investment, partnership and profit sharing, customer relations etc. In fact Islamic finance is not reserved for Muslim community. It is not a Muslim finance and any one, Muslim or not can deal with Islamic financial instruments. Only the thing is that the products are designed according to well defined shariah principles.

Thomas M. Garrett writes – “the religion derives their moral percepts not only from human experience but from divine revelation. It must rely on the unaided human reason”. The well known historian Arnold J. Toynbee mentions – “no society could succeed without any religious aim. Mere desire for prosperity cannot motivate a person for building up an enduring dynamic and progressive nation.” STATEMENT OF THE PROBLEM

There are so many studies available with reference to the Islamic finance and its tools. But studies are scarce in respect of the role of ethics in Islamic finance. The ethics in business is relevant. Especially, in India it is a legal concern and is mentioned in the Companies Act, 2013. More than this, a country like India needs ethics in business for accomplishing her national objectives. SCOPE OF THE STUDY

The study covers an analytical review on Islamic ethics and the various tools and techniques used for implementing Islamic ethics in business.

In a country like India possess a significant Muslim population having Islamic shariah knowledge. This knowledge can be applied for developing socio-cultural environment of the country.

The study is relevant because, ethics whether it is Islamic or not, but business operations must be social oriented. Here, this study attempts to bring the relevance of Islamic ethics in business which is beneficial to both Muslim and non Muslim community. This study gives more light in to the areas where a business can apply its social obligations in Islamic perspective. OBJECIVES OF THE STUDY

• To study the major documentary evidences of Islamic Finance

• To examine the role of ethics in Islamic Finance

• To examine the various ethical tools in Islamic Finance.

• To identify the factors affecting ethical financing.

• To find out the relationship between religion and ethics DATA USED FOR THE STUDY

The study is mainly concerned with secondary data. Data are collected from research papers, books of references, standard publications, published reports of the reputed institutions, periodicals, internet etc. CONCEPT OF ISLAMIC ETHICS IN BUSINESS

The theme behind Islamic finance is not made by human rulers, but is designed by the Almighty through his Divine Guidance. Man is only a vicegerent of God and he is only a trustee of wealth. Islamic business is based on this concept. Since the lack of absolute ownership on wealth may promote a sense of working for society. The ultimate aim of a Muslim is to attain ‘Falah’, that is the victory of here and hereafter. He is more concerned about the ‘Day of Judgment’. Hence his business must be based on socio economic justice and well being of the mankind. Main aims of the Islamic finance are the material and spiritual needs of the stake holders.

In Islamic point of view, economic problems like poverty are not because of scarcity of natural resources, but it is because of the misallocation, mal distribution, mismanagement etc. The ethical objectives of Islamic finance may be as follows.

• Fraud and usury free business

• Prohibition of financial transactions having excessive uncertainty

• Social coercion without class conflict

• Poverty eradication through zakat, sadaqa

• Eradication of social evils such as begging, robbery, theft, sexual exploitation etc.

• Balanced and efficient use of resources

• Women empowerment

• Free from exploitation

• Promote education and health

• Environmental sustainability

• Mutual respect and esteem

• Prohibit illegal transactions in business

• Fulfilling business obligations and contracts. DOCUMENTARY EVIDENCES OF ISLAMIC FINANCE

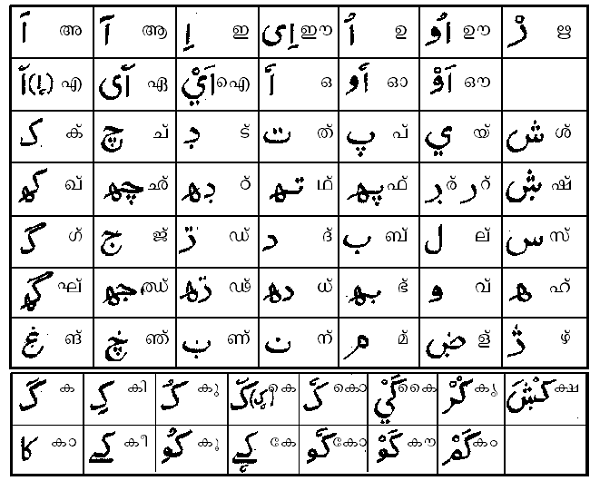

The primary source of evidence is the Holy Quran, the direct words of Almighty, revealed to Prophet Muhammed (pbuh), over 23 years by the angel Gabriel and Sunnah - the Narrative deeds, habitual practices and dealings of Muhammed (pbuh) during his life time.

Secondary source of evidence is Ijma the consensus among the Islamic scholars about a particular issue not specifically envisaged in Quran or the Hadith/sunnah, Qiyas is an analogical deduction by the Muslim Scholars to provide an opinion about an issue not referred in Quran or Sunnah in comparison with another case referred in the Quran and Sunnah and Ijthihad, means the independent jurists’ reasoning relating to the applicability of certain sharia rules on cases not mentioned in either Quran or Sunnah.

ROLE OF ETHICS IN ISLAMIC FINANCE

Quran and Hadith deals with wide range of ethical norms such as dealings in contracts, dealings in business, norms with private and public life, security of life and property, norms in connection with protection of honor and justice etc.

Quran says: “Allah has made business legitimate for you.”

As a Muslim, he should adhere with ethical standards not only in business but also all the aspects of daily life. We can see the clear cut correlation between business and ethics in Islam.

Out of 99 noble names of God (Al-Asma Al-Usna), most of them are connected with ethical norms. These names are likely to motivate a man to do good deeds.

The selected names are as follows

Al- Haq (The Truth), al- Adl (The Just and Equitable), al- Barr (The Righteous), al- Salam (The Peace), al- Hadi (The Guide), al- Wakil (The Trustee), al Khabir ( The Aware), al- Shahid ( The Witness), al- Mu’min (The Faithful), al- Muhaymin ( The Protector), al- Rahman (The Merciful), al- Gaffar (The forgiver), al- Sabur (The Patient), al- Ra’uf (The Compassionate), al- Karim (The Generous), al- Shakur (The Appreciative), al- Wadud (The loving), al- Wali (The Protecting Friend), al- Muqaddim (The Promoter), al-Mughni (The Enriched), al- Razak (The Provider), al- Fathah (The Reliever), al- Nafi’ (The Propitious), al- Wahhab (The Reckoner), al – Muhsi (The Accountant), al- Jami’ (The Gatherer) and al-Hakim (The Judge).

Prophet Muhammed (pbuh) is a typical example for a good business man. In his early age, he is renowned as Al Ameen means trustworthy. The Prophet (pbuh) gives emphasis to honesty and truthfulness in business dealings when he was the business partner of Khadeeja (R).

Sura Al Ahzab (verse 21) points that “for you in the messenger of Allah is a fine example to follow.”

Bukhari reported - “God shows mercy to a person who is kindly when he sells, when he buys and when he makes a claim.”

Prophet Muhammed (pbuh) said: “the honest merchant/business man on the day of resurrection with is rewarded with prophets, pious, virtuous, and martyr people.” (Al-Tirmidhi)

In another Hadith Prophet Muhammed (pbuh) said: If you guarantee me six things on your part, I shall guarantee you Paradise. Speak the truth when you talk, keep a promise when you make it, when you are trusted with something, fulfill your trust, avoid sexual immorality, lower your eyes and restrain your hand from injustice.”

Faith in Allah (Taqwa) is the framework for Muslim entrepreneur to molding the prosperity of his business. More over Muslim must conduct his business in accordance with Islamic principles because he believes that Allah himself is a witness for all of his actions and transactions. So he does halal business for his earnings. The business against social and economic interest must be avoided.

Quran says: “O ye people eat of what is on earth lawful and good; and do not follow the footsteps of evil one for He is to you and avowed enemy” – Al Baqarah 2:168

The moral of entrepreneur can see in Quran as “But Allah hath permitted trade and forbidden usury (riba) – Al Baqarah 2:275

ETHICAL TOOLS IN ISLAMIC FINANCE

Islamic finance based on the principles of Islamic law (shariah) and guided by Islamic economics. Shariah principles consist with prohibition of unethical, immoral and speculative activities. In Islamic finance money is only treated as the medium of transactions. Money is not used as a commodity with which to make profit. Banks deals with goods and documents. By engaging business and trade, money is converted in to something useful which in turn generate reasonable profit.

Prohibition of interest and speculation are the basic philosophy of Islamic institutions is which have been revealed in Quran. Both of these prohibitions were extended and elaborated on by the Prophet Mohammed (pbuh) through the sunnah.

Zakah

Zakah literally means “growth”, “increase”, and “purity. Zakah is one of the five pillars of Islam. It is the most important fiscal and distributive mechanism of an Islamic economy. Zakah is for the welfare of the society. It meets the basic needs of the poor. In Islam Zakah is compulsory. It is the levy on the wealth of the members of Muslim community.

It is the amount payable by a Muslim on his net wealth as a part of his religious obligation, mainly for the benefit of the poor and the needy. Every Muslim is responsible, who owns more than the exempted minimum to pay Zakah on it and it is the duty of Islamic state to collect and distribute it according to the manner prescribed by Quran.

Its importance can be judged by the fact that Quran narrate about zakah in various verses. In most of the verses, we can see that the Quran command injunction to perform prayers followed by the recommendation regarding zakah. Zakah accomplishes the socio economic needs of the society.

“Those who establish regular prayers and regular zakah, and have (in their hearts) the assurance of the hereafter” – Quran (31:4)

Social importance of Zakah

1. Zakah increases the productivity and flexibility of individual’s income and national income.

2. It helps to redistribute and reallocate the national income in favor of poor and other needy people.

3. Zakah reduces the economic disparities

4. Zakah restrict the conspicuous consumption of rich people.

5. It helps to increase investment.

6. State can utilize the idle (zakatable) income more effectively.

7. Zakah increase the morale of poor.

8. It helps to stimulate aggregate demand and purchasing power.

9. It eradicates poverty and ensures social security.

Sadaqa

Social spending is the best way for the social development. Social expenditure promotes equitable distribution of wealth and resources. Sadaqa is a tool for social spending. It is a voluntary charity in Islam by expecting reward from Allah both in this world and hereafter.

Prophet Muhammed (pbuh) said: every good deed is a form of sadaqa.”

Any act which makes joy or benefits to others like smiling at someone, speaking a kind word, guiding other person, eliminating harmful objects from passageway, helping a blind human being etc., but the term sadaqah most commonly used to refer to charitable giving.

An institution can utilize the sadaqah fund for the areas such as job skill training, educational assistance for the poor, marriage support, widow/orphan support, green energy, animal farming, disaster management etc.

Waqaf

Waqaf is a shariah compliant voluntary charitable endowment from one’s personal belongings or wealth in the form of cash or property. Waqaf is the perpetual investment in Muslim community on behalf of Allah. It is a voluntary social expenditure for the creation of nonprofit making institutions. Waqaf assets are commonly financed in mosque, schools, research, hospitals and social services. Waqaf is a CSR tool to reach the community and cater the different needs of the stakeholders through the following ways

• Charity and Health Programs

• Community Development Programs

• Assistance to Orphan and Destitute

• Entrepreneurship and Human Capital Development

• Endowment Funds

In His Quran Allah says: “the example of those who spend their wealth in the way of Allah is like a seed (of grain) which grows seven spikes; in each spike is a hundred grains. And Allah multiplies (His reward) for whom He wills. And is all-Encompassing and Knowing”

The Prophet (pbuh) said: “When the son of Adam dies, his actions come to an end except for three; Sadaqa Jariyah (ongoing charity), knowledge which brought benefit and a pious child who make supplication for him”.

Qard Hassan (Interest free Loan/ Benevolent Loan)

It is a form of financing in which the borrower obligated to repay the principal amount of loan at the stipulated future time but no interest is charged. It is mainly used for welfare purposes. It can be used as an alternative tool for short term financial needs of the business such as working capital requirement. Also the granting of qard to needy customers increases market demand of the durable products. It is helpful to poor farmers to purchase seed and fertilizers without much economic burden .Firms can use qard as tool for corporate social responsibility to fulfill their social obligations. FACTOR AFFECTING ETHICAL FINANCING

Divine ownership (Thouheed) and vicegerent of God - Absolute ownership of everything belongs to God. Man in earth is a vicegerent of God and his earnings and payments only on the pleasure of God. Man is only a trustee and his actions are under the command of his master.

Divine Accountability - According to the Quranic teaching, all the human actions and transactions are directed towards the achievement of Falah (the pleasure of God). He is accountable for all the actions on the Day of Judgment. So he should take the steps to make victory not only here but also hereafter.

Principle of Moderation - Islam discourages two extremes of miserliness and extravagance. It promotes moderate consumption and spending. Islam eliminates greed and misery. Preservation and conservation of natural resources can be done by applying the Islamic principles of moderation.

Equity and not equality - Islam provides equal opportunities to all to establish equity.

Concept of Halal and Haram - Islam makes a clear cut difference between permitted (halal) and unpermitted (haram) actions. A business should take in to consider the halal and haram situations while conducting business.

Spiritual and moral development – this can be done through the complete obedience to God. Spending in the way of God makes spiritual and moral development. CONCLUSION

Islamic finance plays a unique role in the socio economic development. It provides more importance to human life and social development than concentrating upon the wealth and extra ordinary profit making life. Islamic finance encourage the investments making social and economic developments such as house hold priority, education, health etc instead of a mere investment for profit making enterprises. It also plays a dominant role in the reduction of vulnerability of human life.

It plays a vital role in both micro and macro aspects of economy. It makes an ethical platform for doing a business for an individual development as an entrepreneur and also focuses social development by prohibiting interest, exploitation, gambling and excessive uncertainty by Divine Law.